Winning the Cash-Out Game with Poker Bot Smarts

Poker bots have graduated from geeky side projects to round-the-clock profit engines. Their edge no longer comes only from perfect card play; it hinges on converting chips to real dollars without tripping site security or suffering a catastrophic downswing. That same discipline—knowing when and how to lock in gains—now attracts quant traders hunting for sharper exit rules in volatile markets. By unpacking bot cash-out tactics we can borrow proven ideas for any setting where edge, risk, and timing intersect.

Three Pillars of a Profitable Bot Bankroll

- Segregate capital and profit. A strong bot bankroll is ring-fenced; winnings flow to a separate wallet while the playing roll stays constant. The separation contains variance shocks and mirrors the way professional desks peel off daily trading P&L before resetting risk books.

- Scale through micro-edges. Modern bot farms grind lower-stake tables where mistakes are plentiful and detection is slower. Individually the edges look tiny—often 2-4 big blinds per 100 hands—but when 50 instances run automatically, edge compounds just like high-frequency scalps in liquid futures.

- Automate draw-down brakes. When the equity curve dips a preset percentage, bet sizes shrink or the instance pauses. The logic echoes institutional “kill switches” that throttle lot size after a bad run to protect trading capital.

Math Behind the Instant Cash-Out Button

PokerStars’ “All-in Cash Out” feature crystallizes bot logic into one neat formula:

cash-out value = (pot − rake) × win-probability × 0.98.

Pot behaves like position size; rake equals transaction cost; win probability is the bot’s real-time edge; the 2 % haircut prices liquidity. A bot uses its equity calculator to decide whether the guaranteed, discounted payout beats the variance of finishing the hand. Quant funds apply the identical test when selling out of a spiking meme stock or delta-hedging a volatile option: immediate, smaller certainty versus uncertain, larger upside.

Counterfactual Regret Minimization: Engine of Adaptive Exits

Behind every withdrawal lies counterfactual regret minimization (CFR). The algorithm tallies the “regret” of not picking an alternative line each time a decision node repeats. Positive regret tells the bot an action deserved more weight; negative regret prunes it away. Over millions of iterations CFR converges toward a Nash-proof strategy that includes optimal exit points.

Translating CFR to markets, quants compute the regret of holding versus trimming at each price ladder rung. Systematic strategies such as vol-target portfolios already mimic this by shrinking weight as volatility (a proxy for regret) rises.

Out-Smarting Detection: Stealth Techniques with Market Parallels

Poker rooms ban bots, so operators hide in plain sight:

- Randomized timing: Actions fire at jittered millisecond windows to evade pattern trackers—akin to iceberg orders that random-slice large trades.

- Bet-size fuzzing: Instead of solver-perfect sizes, bots inject small noise, matching how smart execution algorithms vary clip size to avoid signaling.

- Multi-account dispersion: Profits flow through many low-traffic accounts, reducing each profile’s heat score. Prime brokers use comparable dispersion when splitting blocks across dark pools.

These cloak-and-dagger layers teach a broader lesson: profitable exits must weigh informational footprint—whether an online room or equities tape will punish obvious, predictable sells.

Kelly DNA: Position Sizing for Long-Run Growth

John Kelly’s log-growth formula appears everywhere bots wager:

f *= (edge)/(odds) → bet only the fraction that maximizes bankroll growth.

A bot’s edge is its equity minus the rake-adjusted breakeven; odds are the pot odds offered. The same fraction sizing drives trend-followers who scale leverage by expected Sharpe. Edge too small? Bet tiny. Edge huge? Press harder but never to ruin.

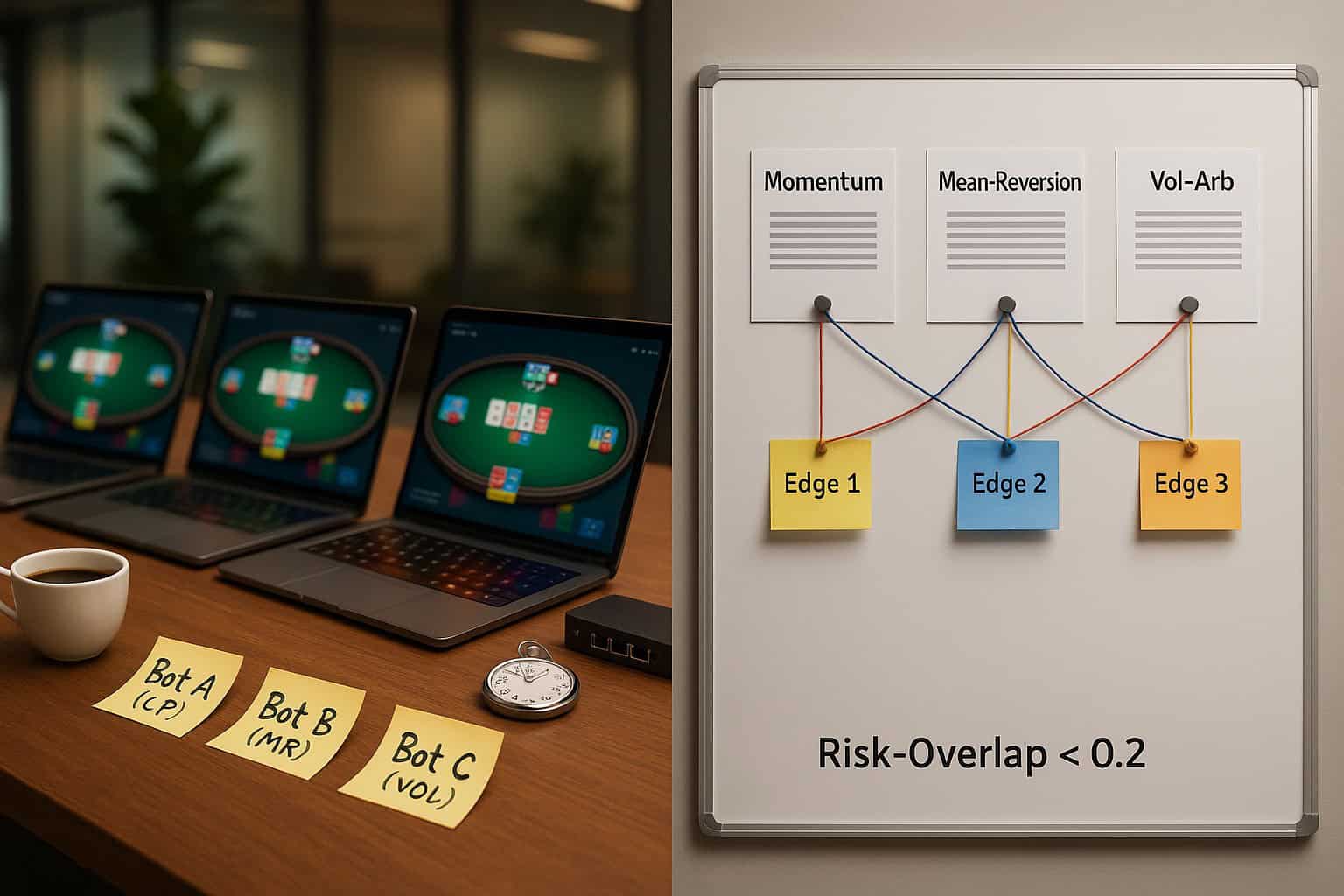

Multi-Bot Coordination = Strategy Diversification

When two or three specialist bots tag-team a table—one exploiting loose limpers, another capitalizing on position—they create what hedge-fund managers call a multi-strategy sleeve. Correlation among lines stays low because each bot hunts different leaks. The portfolio’s equity curve smooths out, permitting larger periodic cash-outs without blowing up variance.

From Tables to Tickers: Concrete Cross-Overs

| Poker-Bot Playbook | Real-Market Twin | Payoff |

| Equity calculator chooses cash-out if EV < certainty-value | Option trader sells gamma as IV collapses post-event | Locks in realized edge before randomness returns |

| Incremental daily withdrawals maintain stealth | Fund sweeps gains to treasuries nightly | Shields working capital from tail events |

| CFR learns exploit windows from hand histories | Adaptive algos re-weight factors after regime shifts | Sustained alpha despite changing field |

| Stack-proportional bet sizing | Risk-parity or vol-targeting | Consistent growth, controlled drawdown |

Ethical & Regulatory Undercurrents

Online poker rooms deploy detection AIs—CAPTCHA prompts, mouse-movement telemetry, statistical profiling—and confiscate illicit winnings. Regulators in finance follow a parallel arc: EU’s MiFID II and the SEC’s Reg SCI demand audit trails and kill-switch logic for automated traders. The lesson: sophisticated exits must integrate explainable logs and limit architecture or face shut-down.

Building Your Own Cash-Out Playbook

- Define edge clearly. Use back-tested expectancy or solver equity, never gut feel.

- Quantify transaction frictions. Factor rake, commissions, liquidity haircuts.

- Set dynamic profit-retention rules.g., withdraw 30 % of weekly net P&L while bankroll > 40 × expected loss.

- Bake in variance-based throttles. Cut size 50 % after 10 % drawdown, restore only after new high-water mark.

- Log every exit. Whether a hand or a trade, archive context for CFR-style regret review.

Conclusion: Edge Is Earned Twice—Once in Play, Once in Payout

Superhuman card logic alone doesn’t pay rent; disciplined cash-out design turns digital chips—or marked-to-market gains—into durable wealth. Poker bots show that bank-roll segmentation, regret-driven exit rules, and stealthy variance controls create a self-healing flywheel of capital growth. Finance can co-opt the same DNA: treat every liquidation as a solvable node in a bigger game tree, maximize long-run log wealth, and leave as little as possible to chance.

By watching how invisible machines beat human gamblers, we gain a blueprint for beating the house rules of volatility—one well-timed cash-out at a time.